AIBFarm Quantitative Trading Assistant

Last Updated: March 2025

Welcome

Our trading strategy is built on a belief in Bitcoin’s long-term value. It focuses on going long on Bitcoin while shorting unsustainable or heavily manipulated coins to generate profits. This assistant tool turns time into your ally, helping you steadily build wealth.

This manual covers the following key topics:

- OKX account and API setup process

- Best practices for funds management

- Proper use of AIBFarm, including trading rules and mindset

- Frequently Asked Questions (FAQs)

🚀 Latest Update:

We’ve released a major system upgrade! For the latest details and how to get started, follow @aibfarmx on X. Always monitor your safety margin closely.

Quick Start Guide

Get started in just 7 steps:

- 🌍 [Sign Up for OKX]

Already have an account? Skip to the next step.

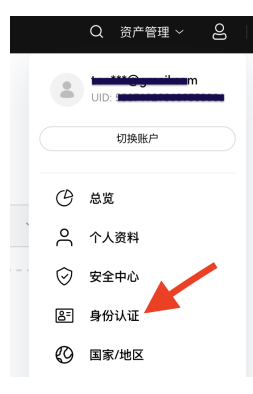

▸ Register using a non-Canadian identity

▸ We recommend using a Chinese identity for faster KYC verification - 🔑 Sub-Account and API Setup:

▸ Create a sub-account and transfer 5,000 USDT to the [Trading Account]

▸ Enable futures trading permissions

▸ Generate the three API components:

🆔 API Key | 🔒 Secret Key | 🎟️ Passphrase - 🕯️ [AIB Token Deposit]

▸ Set up a whitelist for transfers

▸ Deposit 20 USDT worth of AIB tokens

▸ Submit the transaction hash receipt - 📝 [System Registration]

▸ Enter API credentials, email, and a nickname

▸ Select permission mode (Read-Only/Trading) - ✅ [Verification

Test]

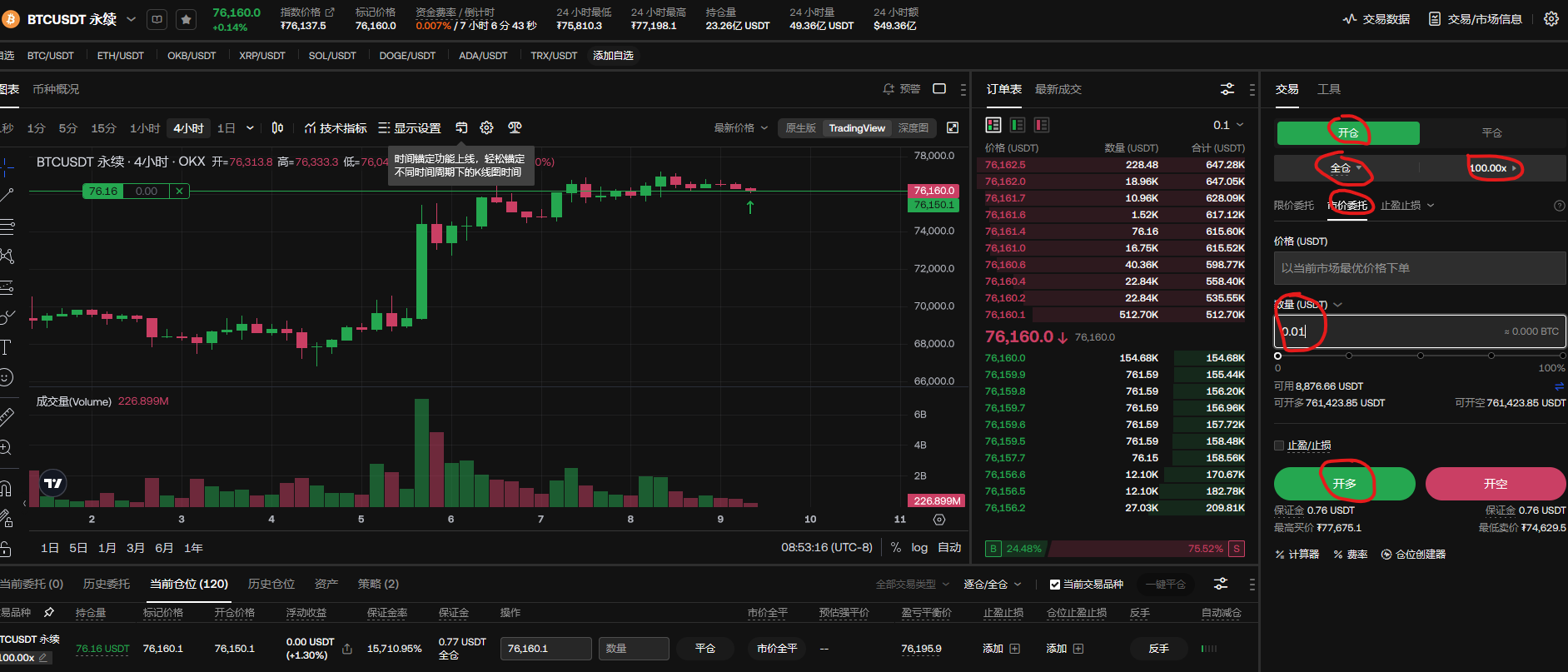

▸ Manually open a 100x BTC long position (0.01 USDT)

▸ Confirm system response and position synchronization - 👁️ [Dashboard]

▸ Demo account: [email protected]

▸ Demo password: aaaa1236

▸ Monitor AI trading records and capital curve in real time - 🐦 [Official X Support]

▸ Stay updated with system announcements

▸ Submit tickets for issues

▸ Join the quantitative trading discussion group

1. Set Up an OKX Sub-Account and Generate API

1.1 Create a Sub-Account

- Log in to your OKX main account

- Navigate to Sub-Account Management in the menu

- Click Create Sub-Account and complete verification

Tip: Don’t have an OKX account yet? Sign up at okx.com

1.2 Generate API Key

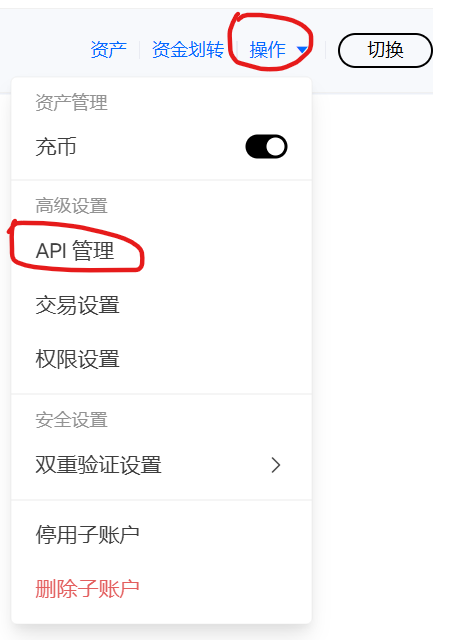

- Go to the API Management page in your sub-account

- Select Create API Key

- Set API permissions (Read-Only/Trading)

Safely store the following information:

- API Key:

xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx - Secret Key:

************************** - Passphrase:

Custom password (not your login password)

2. Submit Required Information

Email the following details to our technical support team:

- API Key:

Paste your API Key - Secret Key:

Paste your Secret Key - Passphrase: The password set during API creation

- Contact Email: Your username for system login

- Sub-Account Nickname: A recognizable name for identification

Security Tip: Never share your Secret Key on public channels

3. Initial Funds Deposit

Funds Transfer Process

- Transfer at least 1,000 USDT to the sub-account’s Trading Account

- Maintain a minimum balance of 2,000 USDT in the funding account (emergency reserve)

Navigation: Funds Management → Account Transfer → Select “Funding Account” to “Trading Account”

Funds Security Tips

- Enable two-factor authentication (2FA)

- Regularly review account authorization logs

- Avoid using the main account for direct operations

4. Accessing the System and Initial Operations

4.1 Log In to the System

- Visit https://dashboard.aibfarm.com/login

- Log in using the email and password from registration

4.2 Account Monitoring

- View available funds balance in real time

- Monitor current position status

- Review historical trading records

The system automatically executes trading strategies. If you notice any issues, contact technical support immediately.

5. Frequently Asked Questions

Margin Management

- You may need to manually top up margin during testing

- We recommend setting price alert notifications

Risk Disclosure

- The system is currently in the V6 feature testing phase, combining Version 1.0 with V5 Beta

- If the safety margin falls below 30, there’s a risk of capital loss

- We advise operating with a risk reserve fund

Learning Resources

Video Tutorial: How to Create an OKX Sub-Account API

FAQs

-

Unable to Deposit on OKX:

We regret to inform you that, per our terms of service, we cannot provide services in certain regions.

Solution: Use a VPN to connect from Japan, Europe, or Singapore. This works on both mobile and desktop. Recommended third-party tools:

-

Incomplete Verification:

Ensure all verification steps, including additional information, are completed.

-

Safety Margin Guidelines:

Beginners: 100x | Intermediate: 50x | Advanced: 30x

-

Account Mode Verification:

Positions won’t open without verifying the account mode. Set “Dual-Position Mode” for the first trade and align with the overall strategy. If unsure, consult us first. The system will open stable initial positions based on its indicators.

Reminder: OKX requires manually opening the first trade (minimum 0.01 USDT, 100x BTC spot) to enable API trading.

-

Does the bot handle opening positions, take-profit, and stop-loss

automatically?

The bot handles opening positions, adding to positions, and partial take-profit but does not set stop-loss. You must set stop-loss manually. Our recommendation: Avoid in-platform stop-loss; instead, keep 70% of your capital off-platform to cover a 30% in-platform drawdown. Two years of data show no liquidations caused by the system’s auto-trading.

-

Are trading positions the same for every account?

No, positions vary based on each user’s historical data. Early on, you may see significant floating losses, but a 30x+ margin and 2x off-platform assets (in USDT or BTC) ensure safety. Temporary losses are normal.

-

What is our strategy?

In short: Short unsustainable coins, go long on BTC. The strategy uses human factors engineering, AI, and large-scale data analysis, continuously evolving to identify new opportunities and avoid heavily manipulated coins.

-

Can I control trades manually via the API?

Yes, you can trade freely on OKX or let the system manage trades, allowing you to rest easy without liquidation risks. However, this is a semi-automated assistant, not a fully automated fund, so some monitoring is required. For a hands-off option, stay tuned for our upcoming fund product, though it will have higher fees.

-

Does the bot automatically trade via OKX’s API?

Yes, but if you notice anything unusual, you can disable the API on OKX and contact us with details.

-

What leverage does the bot typically use?

20-50x for short positions, 100x for BTC long positions (BTC only).

-

How much time do I need to spend daily?

About 15 minutes daily. If you’re less focused on maximizing returns, 15 minutes weekly is sufficient. This is a semi-automated system, so you can monitor as much as suits your trading style, even up to 8 hours daily.

-

OKX prompts: “For asset security, bind an IP address to your API key. Unbound APIs with

trading or withdrawal permissions will be deleted after 14 days of inactivity.”

You can bind the IP later. This requirement will become stricter as user numbers grow.

-

Is AIBFarm free during testing, and will it charge fees later?

Currently, AIBFarm is free for alpha, beta, and official releases, but you must deposit AIB tokens to cover profit-sharing fees. Special early-access versions, like V5 beta, require 100,000 AIB tokens to activate.

-

Where should I store the 2x off-platform reserve?

Keep it ready in an off-platform wallet, preferably in BTC. Only use it if the margin falls below 30x. Otherwise, HODL your Bitcoin for the long term.

-

How much capital was used to profit 2,000 USDT in 30 days?

The key isn’t the capital size but the strategy. Capital ensures no liquidation. For steady wins, maintain a high margin. The only significant risk is if OKX collapses.

-

Can unused USDT in the trading account be moved to OKX’s savings for interest?

No, moving funds increases risk. However, if your margin exceeds 200x, you can allocate a small portion to low-risk savings. With V5, margins decrease faster, optimizing capital use.

-

Why hasn’t my bot opened any positions?

The bot assists, not overworks you, and may be smarter than manual trading. Be patient—it waits for optimal opportunities. You can then add to positions based on your budget and experience.

-

Will the bot increase positions if I don’t add manually?

Yes, but not on a fixed schedule—it depends on market dynamics. Keep off-platform BTC ready for dips (5-10%+ drops) to buy as a hedge. We’re working on automating this, but for now, the testing group will guide manual actions.

-

Does manual adding affect the bot’s strategy?

No, this is a semi-automated assistant. We encourage adding within safe margins to optimize capital efficiency without delaying returns.

-

Will manually added positions trigger take-profit?

Yes, partial staged take-profit applies, but the bot doesn’t handle stop-loss or losses from early closures. The only exception is if OKX delists a coin, causing losses beyond the bot’s control.

-

I closed all positions when my $1,000 grew to $10,000, but the dashboard didn’t update.

I closed them by mistake!

Don’t close everything—it’s a key indicator, like DNA. Keep at least 5 USDT in positions. At 50x leverage, that locks only 0.1 USDT.

-

Reminder: In the discussion group, don’t share your investment amounts or account

balances. I (the admin) won’t share your investments or profits either—just use

percentages.

(No specific answer, just a note)

-

Admin asks: Want to share how you lost 1/5 of your position?

User: I saw a few USDT in my position, opened a 1x trade, it spiked too high, and I set a stop-loss.

Admin: Your loss dragged down the entire test project and broke our no-loss record [laughs]. I was shocked and couldn’t figure out why [facepalm]. This project isn’t for quick profits—it’s a mid-to-long-term strategy, not high-frequency trading.

-

Profits are high, some at 1,000%, but positions are small. Why?

This strategy is designed for consistent small gains.

-

When to add positions or trade manually?

Avoid adding during uptrends. Wait for a downturn, and discuss large manual trades in the group first.

-

My coin hasn’t closed. Is this normal, or did the program fail?

The bot closes slowly during dips. If you feel you’ve earned enough, close manually—it won’t affect the system. Keep the platform’s minimum position to maintain your trading history.

-

Are positions unique per user, and can I see others’ trades?

Yes, positions are unique, and you can only see your own.

-

What does AIB stand for?

It’s our token, symbolizing “temple offerings” :)

V6 Testing

- Expansion to Binance platform, intent strength

- Expansion to BitGet platform, intent strength

V7 Testing

- BTC options strategy, requiring at least 0.1 BTC + 10,000 USDT capital + off-platform >0.2 BTC

© 2025 AIBFarm Quantitative System

Technical Support: [email protected]